The recurring revenue model provides top-line predictability.

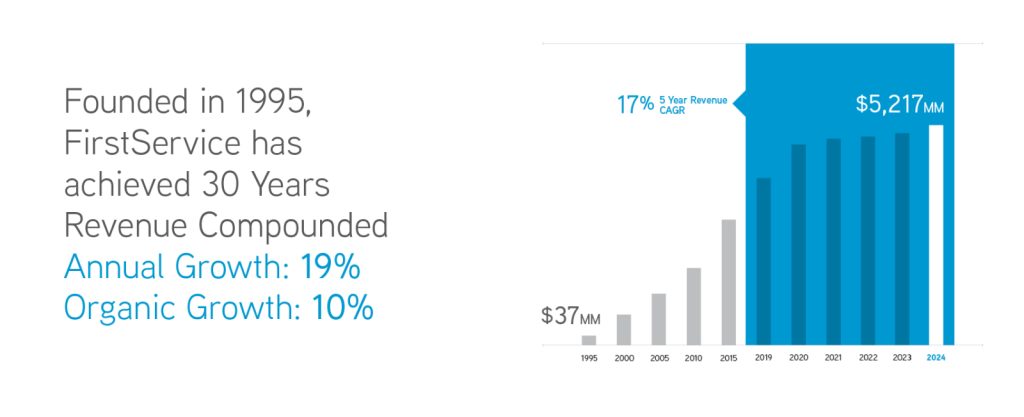

Our discipline and proven business model has led to more than three decades of consistent growth and solid shareholder returns.

Our companies strive to foster a strong culture that embraces diversity and inclusion, attracts those who share our values and offers opportunities for professional development and growth.

Learn what makes FirstService a leader in outsourced essential property services and our companies’ employers of choice in their respective industries.

Note: