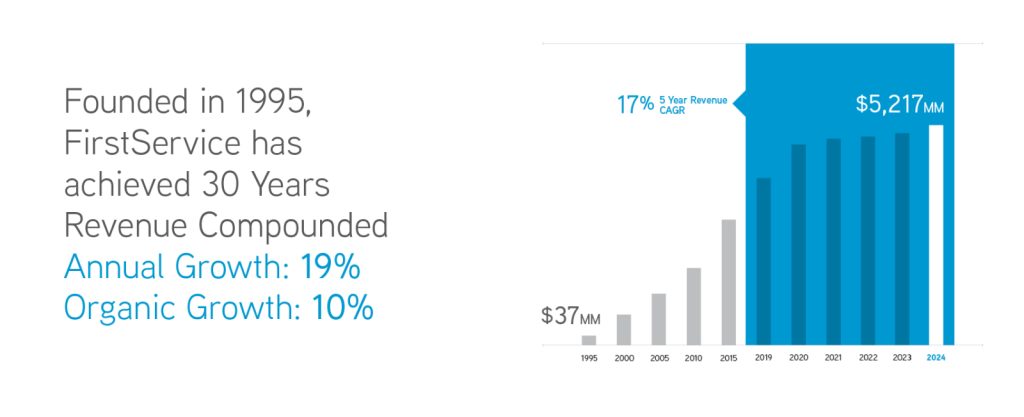

Three decades of compounded annual growth driven primarily by organic growth.

| Year Ended December 31 | |||||

| (US$ thousands, except per share amounts) | 2024 | 2023 | 2022 | 2021 | 2020 |

Operations | |||||

| Revenues | $5,216,894 | $4,334,548 | $3,745,835 | $3,249,072 | $2,772,415 |

| Operating earnings | $337,512 | $244,892 | $219,026 | $201,642 | $169,412 |

| Net earnings | $187,774 | $147,021 | $145,007 | $156,130 | $109,590 |

Financial position | |||||

| Total assets | $4,194,852 | $3,625,743 | $2,774,514 | $2,509,023 | $2,196,540 |

| Long-term debt | $1,298,710 | $1,182,107 | $734,463 | $652,804 | $589,604 |

| Redeemable non-controlling interests | $449,337 | $332,963 | $233,429 | $219,135 | $193,034 |

| Shareholders’ equity | $1,187,746 | $1,024,146 | $907,466 | $799,722 | $660,398 |

Common share data | |||||

| Net earnings per common share: | |||||

| Basic | $2.98 | $2.25 | $2.74 | $3.08 | $2.04 |

| Diluted | $2.97 | $2.24 | $2.72 | $3.05 | $2.02 |

| Weighted average common shares outstanding (thousands) | |||||

| Basic | 45,019 | 44,556 | 44,175 | 43,841 | 42,756 |

| Diluted | 45,280 | 44,795 | 44,494 | 44,401 | 43,184 |

| Cash dividends per common share | $1.00 | $0.90 | $0.81 | $0.73 | $0.66 |

Other data | |||||

| Adjusted EBITDA1,3 | $513,690 | $415,728 | $351,732 | $327,376 | $283,722 |

| Adjusted EPS2,3 | $5.00 | $4.66 | $4.24 | $4.57 | $3.46 |

Notes

| |||||

Our discipline and proven business model has led to more than three decades of consistent growth and solid shareholder returns.

Our companies strive to foster a strong culture that embraces diversity and inclusion, attracts those who share our values and offers opportunities for professional development and growth.

Learn what makes FirstService a leader in outsourced essential property services and our companies’ employers of choice in their respective industries.